By Chrysta Castañeda and Britta Erin Stanton

Author’s note: This article was originally published in Texas Lawbook on August 4, 2021.

The Texas energy grid crisis in February 2021 resulted in extended power outages for millions of Texans, triggering a chain of events that resulted in significant loss of property and life and as much as trillions of dollars changing hands. How did this happen, and where are we now?

To figure out what happened to the grid during winter storm Uri, which left Texas in an icy mess, we have to learn a little bit about the energy system in Texas.

What Is ERCOT?

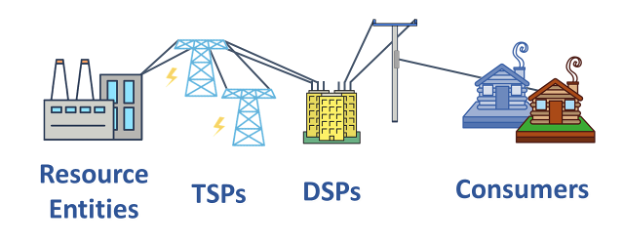

The United States has three energy grids – one for the East, one for the West and one for Texas, which is known as ERCOT. ERCOT is different from other grids in the country in that it takes direction from the Texas legislature and the Public Utility Commission. ERCOT doesn’t create or sell electricity, but rather controls its flow. The so-called major “market participants” in our Texas system are:

- Resource entities, who generate electricity from any source, including natural gas, coal, wind, solar, hydroelectric and even nuclear power; in Texas, there are over 700 generation units that convert raw materials into electricity;

- Transmission Service Providers or TSPs are the high-line owners who take power from plants and deliver them to local networks; there are over 46,000 miles of transmission lines in Texas;

- Distribution Service Providers or DSPs are the companies that deliver power to your doorstep and send you a bill; and

- Consumers; in Texas, there are at least 26 million of us consuming electricity.

What does ERCOT do?

ERCOT’s important functions include ensuring supply meets demand and settling the prices for supplying electricity to and taking it from the grid. Supply must meet demand because we do not yet have the ability to store very much power (system batteries capable of storing electricity at scale are not widely deployed). ERCOT ensures supply meets demand at any given moment by facilitating a competitive market while maintaining reliability. Importantly, supply and demand also set the price of electricity. If supply doesn’t meet demand, ERCOT calls for more power generation.

Why Did Our Supply Fail?

Why did ERCOT fail to ensure we had enough supply for our demand in February? Since the Public Utility Regulation Act of 1999, ERCOT has run on “free market” principles, the most relevant of which are that power supply must meet power demand and that supply and demand set the price for energy. Texas is an “energy only” market, meaning that we pay only for power that is delivered, not extra capacity that is not used.

Why did supply not meet consumer demand? Firstly, demand was at an all-time high. The increase in overall demand growth in the state, coupled with cold temperatures, meant demand was incredibly high. In Texas, because generators run when the market prices indicate they should, supply generally meets expected demand. But to pump up supply during peak-demand periods, the “market solution” leads to an even higher price for electricity. However, beginning Feb. 15, the market solution encountered serious problems.

When things were freezing early in the morning of Feb. 15, some generation began to trip offline due to a variety of factors, including natural gas not getting to generation plants to fuel them and electricity not getting to natural gas production facilities (resulting in those facilities not being able to produce natural gas). Because of the high demand and a diminished supply that was not being solved by “market solutions,” ERCOT directed participants to voluntarily decrease demand or “load shed.” That meant cutting off customers from the grid. (If demand does not equal supply at every moment, the grid becomes unstable in a way that can lead to permanent failure; hence, load had to be shed to maintain stability.)

ERCOT sets the price of electricity every 15 minutes, but, as during Winter Storm Uri, prices can get a little crazy. By law the maximum price of a megawatt-hour of electricity is $9,000 (known as the high-offer cap or HCAP). That’s a high price. Generally, the price is around $40/MWh. ERCOT wants the high prices to signal to generators to put all of their production online. But the price didn’t hit the cap of $9,000 automatically Feb. 15 when supply fell short of demand, contrary to ERCOT’s design. Instead, when ERCOT gave the signal to shut off load, the ERCOT software treated it as if that demand simply didn’t exist, therefore, it balanced the price at a much lower level, where the reduced supply met the artificially reduced demand. When the PUC found out that was happening, they directed prices be set to the max – or $9,000/MWh.

Eventually, as we know, generators were able to restore all their production capacity, Texas started to thaw, electricity returned and by Feb. 19 temperatures rose and prices dropped.

The Litigation Fallout

After the storm, everyone had to contend with the $9,000/MWh prices. Consumers don’t want to foot the bill. Some retail providers have already filed for bankruptcy. Others, such as certain municipality cooperatives, are arguing their small customer base cannot afford the prices and have obtained injunctions against ERCOT passing the prices through to them. To make matters worse, the “uplift” rule says that if someone doesn’t pay their bill for electricity to ERCOT, everyone else bears the costs of the shortfall. Multidistrict litigation for personal injury and property claims against ERCOT has ensued; some of the MDL claims include suits against electricity distributors, utility firms and generators for allegedly failing to anticipate electricity demands before the storm as well as failing to procure enough electricity to satisfy demand. It is an open question whether or not ERCOT has sovereign immunity, because it is not technically a branch of Texas government even though it performs some governmental functions. And, as a nonprofit entity, it would be subject to certain damage caps under the Texas Civil Practice and Remedies Code.

Market participants have also filed direct appeals from the PUC orders setting the price at $9,000/MWh to the Third Court of Appeals. It will likely be quite some time before the question is finally answered: What was the price of electricity Feb. 15 through Feb. 19?

The Legislative Response

There has been a quite measured legislative response. For its part, the Texas Legislature expanded the PUC by two commissioners, is requiring ERCOT board members to live in Texas and has required some winterization measures be undertaken by natural gas production companies, as determined by the Texas Railroad Commission. The Legislature has also established restrictions on lobbying and created some new committees. As for the market itself, the transmission planning and approval process has been amended. The way wholesale energy is procured and priced has undergone some changes, and some retail products are now banned (goodbye, Griddy). Finally, as for paying for this mess, the Legislature established a process for securitization of certain costs and uplift charges to allow those who were forced to purchase at the HCAP price the ability to pay off those debts over the next 30 years.

Will it be enough to prevent future outages? Time will tell. But unless we expect demand to decrease (highly unlikely), we’re at the mercy of Texas weather and a market-centric system that no longer seems to function well enough to provide the “Reliability” that is baked into ERCOT, aka the Electric Reliability Council of Texas.

One final note: We acknowledge that the system is quite complicated and that the causes and effects of the ERCOT grid failure are still being investigated. The only thing that’s fully agreed upon is that Texas was a cold and expensive place to be in February!

Chrysta Castañeda is the founder of The Castañeda Firm. She specializes in energy litigation and was the 2020 Democratic nominee for the Texas Railroad Commission.

Britta Stanton joined The Castañeda Firm as a partner this year. She practiced for more than 15 years at two prominent Texas litigation boutiques and has also worked as a jury consultant.